About This Video :

The residence mortgage course of in India usually entails a number of steps, from making use of for the mortgage to receiving the disbursement. Here’s an outline of the final course of:

1. Eligibility Check:

Age: Most banks or monetary establishments have an age restrict for eligibility (often 21 to 60 years for salaried workers, or 65 for self-employed people).

Income: Your earnings stage determines the mortgage quantity you’ll be able to borrow. Banks usually require proof of steady earnings (pay slips, ITR, and many others.).

Credit Score: A better credit score rating will increase your possibilities of mortgage approval. Banks usually search for a rating of 750 or above.

Employment/Business Type: Banks will verify whether or not you’re employed with a steady employer or for those who run a enterprise.

2. Choose the Loan Type and Lender:

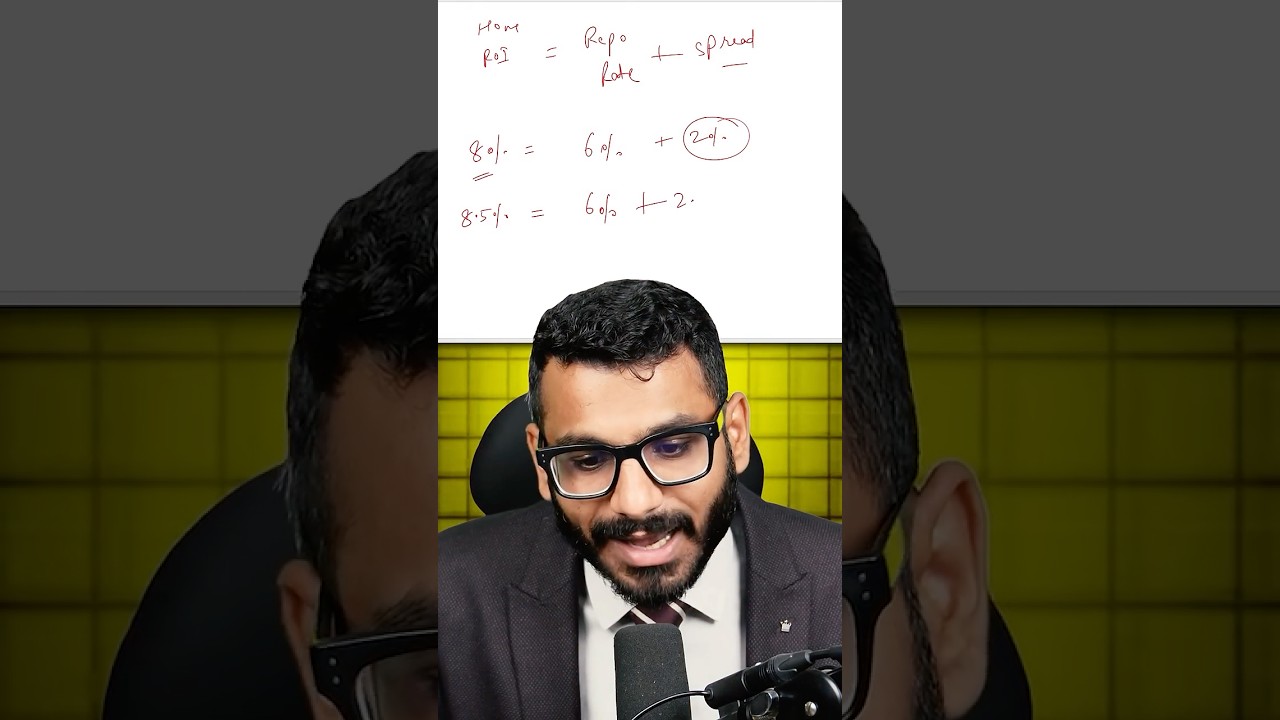

You can select from varied mortgage varieties: mounted charge, floating charge, or semi-fixed charge residence loans.

Compare rates of interest, processing charges, and mortgage phrases from completely different banks and lenders earlier than deciding on one.

3. Application Process:

Documents Required: Common paperwork embrace proof of identification (Aadhar card, PAN), proof of handle, earnings proof (wage slips, ITR), property-related paperwork, and financial institution statements.

Loan Application Form: Fill out the applying kind supplied by the lender.

4. Loan Processing & Document Verification:

The lender will confirm the paperwork and consider your eligibility.

The lender might also conduct a private dialogue or interview to additional assess your profile.

5. Property Verification:

Lenders will confirm the property you propose to purchase or assemble. This consists of assessing the authorized standing, possession, and market worth.

A authorized verification of the property and a technical verification (evaluating the property’s situation and worth) are usually performed.

6. Loan Sanctioning:

After all of the checks, the lender will approve the mortgage. They will challenge a sanction letter specifying the mortgage quantity, tenure, rate of interest, EMI quantity, and different phrases.

The mortgage quantity sanctioned is often as much as 80-90% of the property worth.

7. Sign the Agreement:

Once you settle for the mortgage sanction letter, you must signal a mortgage settlement with the lender. This settlement outlines the phrases and situations, together with the mortgage quantity, rate of interest, compensation schedule, and many others.

8. Disbursement of Loan:

After signing the settlement, the lender will disburse the mortgage quantity.

For under-construction properties: The mortgage is disbursed in levels as per the development progress.

For ready-to-move properties: The full quantity is disbursed after registration.

9. EMI Payments:

Once the mortgage is disbursed, you’ll begin paying your month-to-month EMI (Equated Monthly Installment). The EMI is mostly paid by means of post-dated cheques or an auto-debit facility.

The mortgage tenure usually ranges from 10 to 30 years, relying in your age and compensation capability.

10. Loan Closure:

Once the complete mortgage quantity has been repaid, you’ll get a No Objection Certificate (NOC) from the financial institution, confirming the mortgage closure.

The financial institution can even hand over the property papers (if any) to you.

Key Considerations:

Interest Rate: Fixed-rate loans provide stability however could have greater charges initially. Floating-rate loans rely on market fluctuations.

Processing Fees: Banks often cost a processing price (usually 0.5%-1% of the mortgage quantity).

Prepayment & Foreclosure: Many banks permit early mortgage compensation with or with out penalties, relying on the mortgage settlement.

source