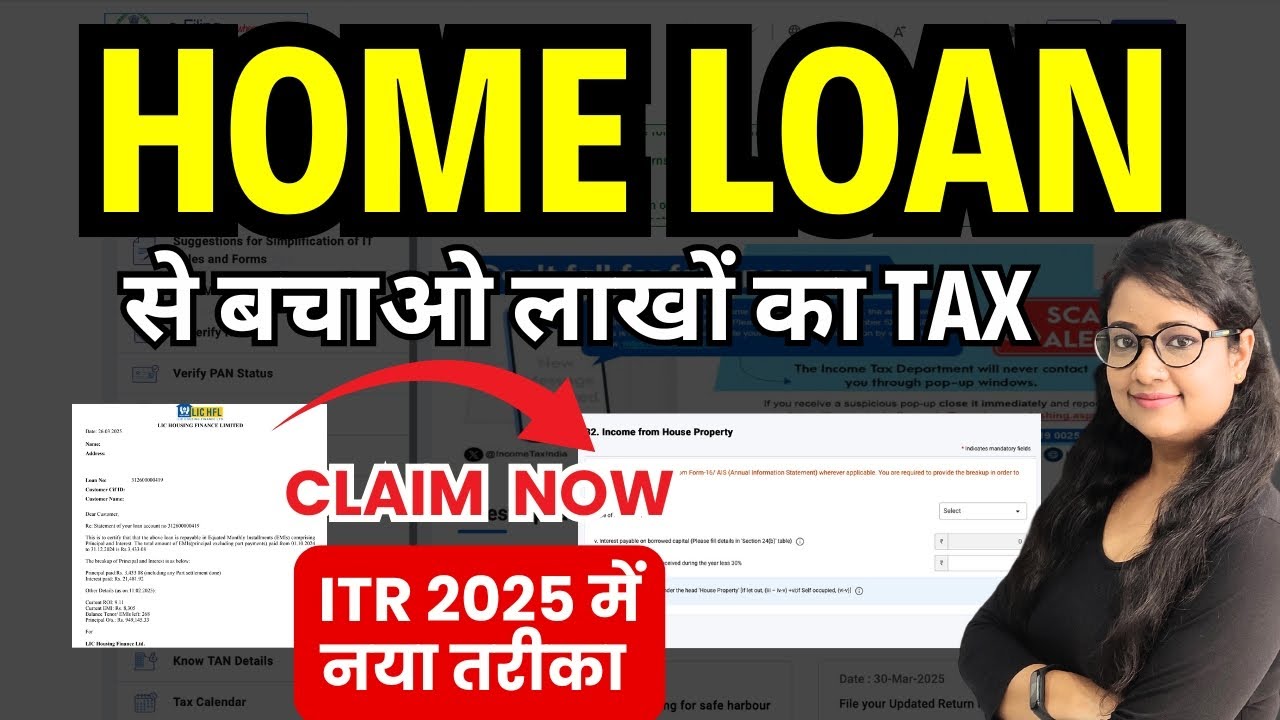

Took a house loan? You can save Tax of Lakhs! In this video, CA Guruji explains how to claim dwelling loan curiosity and principal advantages beneath Section 24(b), 80C, 80EE and 80EEA in ITR for AY 2025–26. Learn the precise steps, paperwork wanted, and customary errors to keep away from whereas submitting ITR.

🔹 Interest Deduction: ₹2 lakh

🔹 Principal Deduction: ₹1.5 lakh (beneath 80C)

🔹 Extra Benefit for First-Time Buyers (80EEA): ₹1.5 lakh

✅ Don’t file ITR with out watching this!

#ITR2025 #HomeLoanTaxBenefit #CAGuruji #IncomeTaxIndia #80C #80EEA #taxsavings

👉You can contact staff of Tax Experts to file Your ITR at 9150010300 or go to www.legalsahayak.com

______________________________________________

💁🏼 सीखें

📞 Call at 9150010400 (just for programs)

______________________________________________

ITR-1 Live submitting:

ITR-4 Live submitting:

______________________________________________

💁🏼 सीखें

📞 Call at 9150010400 (just for programs)

____________________________________________________

Let’s Connect on social media :

🙋🏻♀️what’s up:

🙋🏻♀️Instagram:

🙋🏻♀️Telegram:

🙋🏻♀️YouTube:

🙋🏻♀️Twitter:

🙋🏻♀️Facebook :

🙋🏻♀️Linkdin: www.linkedin.com/in/cagurujiclasses

🙋🏻♀️

📚👩🏻💻Website: www.cagurujiclasses.com

📚👩🏻💻 TAX UPDATES:

_________________________________________________________________

सीखें Trademark Registration:

_________________________________________________________________

सीखें GST:

_________________________________________________________________

सीखें Income Tax , ITR, TDS:

_________________________________________________________________

सीखें Accounting with Tally Prime:

_________________________________________________________________

सीखें How to Register Company/Company Kaise Banaye :

_________________________________________________________________

सीखें GSTR 2B Reconciliation:

_________________________________________________________________

सीखें MSME Registration:

_________________________________________________________________

सीखें TDS & TCS Return filings:

_________________________________________________________________

सीखें Automation of Balance Sheet:

_________________________________________________________________

सीखें TDS on property:

_________________________________________________________________

सीखें GSTR 9/9C:

_____________________________________________________________

♥Like 👍 ♥ Share ♥Subscribe ♥ press the 🔔

_____________________________________________________________

Disclaimer: our movies are for academic functions solely, we is not going to be accountable in any circumstances for any determination which you will have taken after watching the content material

source