Need funds to handle your small enterprise? SMFG India Credit offers unsecured enterprise loans upto INR 75 lakhs* at affordable rates of interest, with minimal documentation and versatile compensation tenures. Get the funds it’s essential to higher handle stock, rent personnel, promote your enterprise on digital platforms, and extra! Before you apply for a enterprise mortgage in India, please verify the lender’s web site and make sure that you match the lender’s eligibility standards.

*Terms and Conditions apply. To know extra about SMFG India Credit Business Loan, click on right here:

#BusinessLoans #SMFGIndiaCredit #SMFGBusinessmortgage #businessloan #smallbusinessloans #unsecuredloan

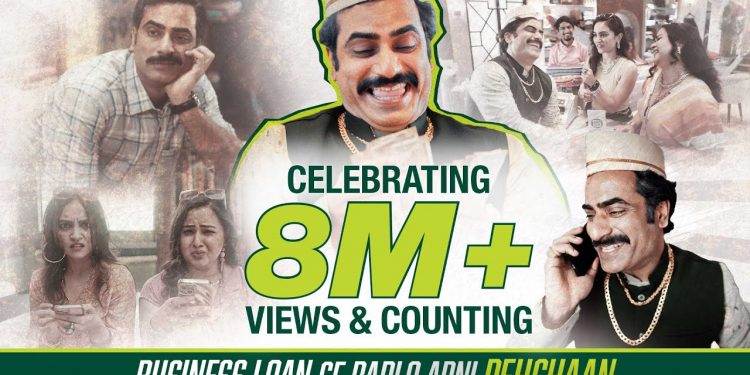

This promotional video describes the journey of a small retailer who was in a position to resolve his stock administration and personnel points with a enterprise mortgage, and develop his enterprise. With SMFG India Credit’s Business Loans, gasoline your enterprise goals and make your personal id of progress. Ab enterprise badhane ki hogi baat, aur pehchaan bhi hogi kuch khas!

#Success #Empowerment #PragatiKiNayiPehchaan

Subscribe to our YouTube channel and watch extra informational movies about private finance:

You can be in contact with us on:

Facebook:

LinkedIn:

Instagram:

Twitter:

====================================================

SMFG India Credit is among the many main NBFCs of India. Since its launch in 2007, SMFG India Credit has efficiently and strongly established itself, unfold throughout the nation’s broad monetary panorama, with a PAN India department community serving thousands and thousands of consumers. Our companies are devoted to supply financing to the underserved segments, together with retail shoppers and small enterprise house owners / SMEs. We provide unsecured in addition to secured financing by means of an array of merchandise together with private loans, business automobile and two-wheeler loans, house enchancment loans, loans in opposition to property and private loans. SMFG India Credit is wholly owned by the Sumitomo Mitsui Financial Group (SMFG).

source